DeFi's 2025 Paradox: The Hidden Boom (- Ouch!)

DeFi's Mid-Crash Makeover: How Smart Investors Are Finding the Gems

H2: The October 10th Crash: Opportunity in Disguise

Okay, folks, let's talk DeFi. I know, I know—the "October 10th crash" still stings. We saw the headlines, the red numbers flashing across the screen, the collective groan rippling through the crypto community, but I want you to do something for me: zoom out. Way out. Because what looks like a disaster up close often reveals itself to be an opportunity in disguise, a crucible forging something new and stronger. Think of it like this: a forest fire clears out the deadwood, making way for new growth, right?

H2: Adaptation and Innovation in the Post-Crash Landscape

And that's exactly what we're seeing in the DeFi space right now. That FalconX report everyone's been glancing over? Buried in the numbers is a fascinating story of adaptation, of smart money flowing towards innovation even as the tide seems to be going out. Forget the doom and gloom; let’s dive into how savvy investors are navigating this post-crash landscape and positioning themselves for the next wave.

H2: Recalibrating: Safer Harbors and Fundamental Catalysts

The key takeaway? It's not about abandoning DeFi, it's about recalibrating. As Martin Gaspar at FalconX put it, the crash "continues to reverberate," but within that reverberation are distinct signals. Investors are flocking to safer harbors, yes—the "buyback names" like HYPE and CAKE, projects with solid foundations and a commitment to rewarding their holders. But they're also chasing fundamental catalysts, the projects that are actually doing something new and exciting, like MORPHO and SYRUP, which shrugged off the Stream finance collapse and kept on building. That's the kind of resilience that gets my attention. The kind that makes me think, "Okay, these guys are here to stay."

H2: Bargain Hunting: Shifting Valuations in DEXes

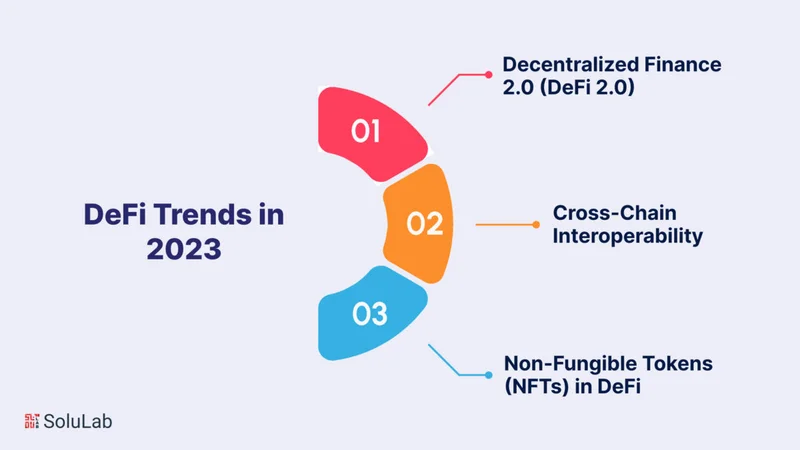

And here’s the really exciting part: the valuation landscape is shifting. Spot and perpetual decentralized exchanges (DEXes) are getting cheaper relative to their activity, which, to me, screams "bargain." Some DEXes, like CRV, RUNE, and CAKE, are increasing their fees, even now. I mean, come on! Who wouldn't want to get in on that? DeFi Token Performance & Investor Trends Post-October Crash

H2: Maturation: Utility Over Speculation

But what does this all mean? Are we just seeing a temporary flight to safety, a blip on the radar? Or is this the beginning of a fundamental shift in how we value DeFi projects? It's like the early days of the internet boom: everyone was throwing money at anything with a ".com" at the end, but eventually, the market matured, and only the companies with real value, with actual utility, survived. We're seeing that same maturation process play out in DeFi right now. The tide is going out, and we’re finally seeing who was swimming naked—and who was building a real business.

H2: DeFi's Mainstream Move: Lending and Yield Opportunities

Lending platforms, for example, are becoming increasingly attractive as investors seek stablecoins and yield opportunities. It’s almost like the old saying, “When there’s a crisis, buy land.” People are seeking safety, and in the DeFi world, that means lending and yield-related activities. But it also means something more profound: that DeFi is becoming less about speculation and more about real-world financial services. AAVE's move toward high-yield savings accounts? Morpho expanding its Coinbase integration? Folks, this is DeFi stepping out of the shadows and into the mainstream! When I saw that, I literally pumped my fist in the air because it is the signal that my dream of a decentralized financial world is taking shape.

H2: The Human Element: Accessibility, Transparency, and Equity

And it's not just about the technology, it's about the human element. It's about creating a financial system that's more accessible, more transparent, and more equitable. That's why I'm so excited about the potential of DeFi, even in the face of market volatility.

H2: A Word of Caution: Volatility and Due Diligence

But, a word of caution: this is crypto, folks. Volatility is the name of the game. Don't go throwing your life savings into some obscure DeFi project without doing your homework. Understand the risks, manage your expectations, and, most importantly, believe in the underlying vision.

H2: Building a Better Financial Future

What's the big idea here? It’s not just about making money (although, let's be honest, that's part of it). It's about building a better financial future, a future where everyone has access to the tools and resources they need to thrive. What this means for us is a chance to be a part of something bigger than ourselves, to shape the future of finance in a way that benefits everyone.

H2: The DeFi Renaissance

I’m not saying it's going to be easy; there will be bumps in the road, setbacks, and moments of doubt. But, I believe that the DeFi sector is entering a new phase of maturity, a renaissance if you will. And those who are willing to embrace the challenge, to learn from the mistakes of the past, and to build for the future will be the ones who reap the rewards. So, keep your eyes open, do your research, and get ready to ride the next wave. The future of finance is being built right now, and it's more exciting than ever.

Why Crypto Stability Is a Total Lie. - Market Meltdown?

Next PostStill Screwed: The Truth About DeFi's 'Recovery.'

Related Articles